Lately we have seen many VARs looking to move a portion of their clients to either a Managed Service or some type of XaaS Cloud based service. However it is not just the technology the reseller has to consider as part of this strategy. Any move to transition business to this type of recurring revenue model will have a significant effect on the organisation at a business level – ie. working capital, cash flow, remuneration structures for sales reps and of course financial reporting and/or how the business is valued.

Unfortunately our experience in working with both vendors and partners alike, is that many do not fully understand the financial ramifications, and therefore the benefits and pitfalls, of a recurring revenue model. One such example is the “Rule of 78”.

Put simply the Rule of 78 is a quick calculation for those who need to estimate the total value of recurring revenue over the next 12 months.

There are many ways of reporting or estimating recurring revenue, some more effective or realistic than others. For instance many Telcos, ISPs or MSPs report or forecast their revenue as an “annualised” run rate of 12 times the average monthly billing, plus new revenue acquired over the period. i.e. if I bill $10 per month for the service the “annualised” value is $120.

Using either annualised billing or the Rule of 78 is often done by an annuity based business to increase the underlying value of the business to create a higher forecast or “potential” revenue figure, but also to make the business more comparable to a traditional product sales business over a given financial year.

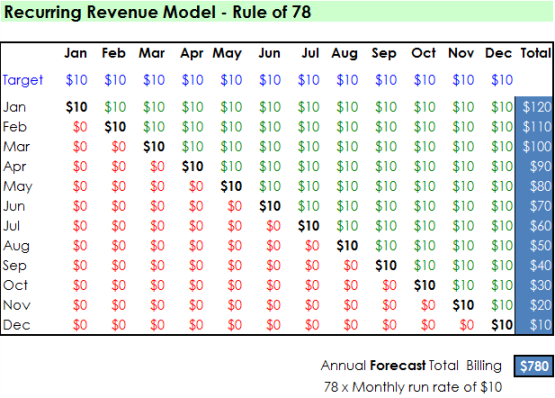

Some telcos use a more generous extrapolation of the monthly sales figure to create a forecasted year of billing, which is known as the Rule of 78. Put simply it is the value of the first month’s service multiplied by 78. The table below shows how and why the 78 multiplier works.

When you install $10 of recurring revenue on January 1st, you will receive $10 of revenue every month for that year. Therefore, $10 of new sales in January = $120 of revenue for the year.

The next month when you install $10 of recurring revenue on February 1st, you will receive $10 of revenue for 11 months for that year. Therefore, $10 of new sales in February = $110 of revenue for the year. The following month when you install $10 of recurring revenue on March 1st, you will receive $10 of revenue for 10 months for that year, and so on, and so on.

When you add up all of the annual billing “opportunities” there are 78 over a 12 month period i.e. 12 + 11+ 10 +9 etc etc = 78. Hence the Rule of 78.

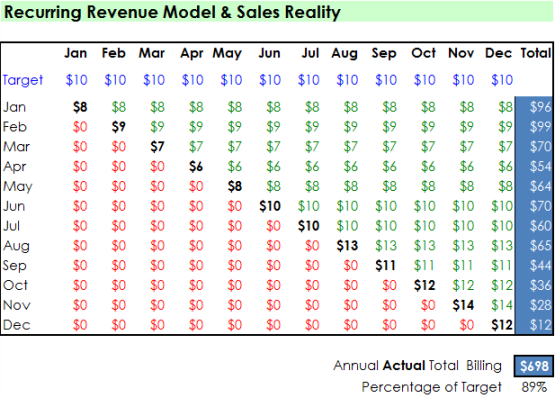

However the major flaw in using the Rule of 78 in this manner is that it assumes that the same amount will be billed and added to the run rate every month for a full year. But rarely does this happen in reality. Often you will see this forecasting approach taken by telcos or xSPs looking to talk up or improve their business valuation by ignoring seasonality, market fluctuations and of course churn or billing defections.

In fact, the concept of annualised billing and the Rule of 78 is something that many sales managers do not fully understand when looking to obtain an annual billed revenue target for their sales staff. The rule explains why selling, provisioning and billing recurring revenue sooner in the reporting year is so important to achieving your annual revenue goal.

Using the same example of a sales target for new business of $10 per month or $120 of new billing we should end up with a total of $780 billed, but in reality the annual billed revenue can be materially different depending on when these sales dollars come in.

As can be seen by the example above, getting a good start to the year is vital if the overall revenue target is to be achieved. There are not enough billing opportunities if a sales person leaves their run too late, even if they do over achieve their monthly sales target in the last few months of the year.

In fact, if you look closely at this example, the sales person way over-achieved in the last 7 months, and by December was hitting their total monthly new sales target of $120, but because of the slow start, they only finished with billed revenue of 89% of target (ie. $698 against the theoretical target of $780).

Customer billed revenue keeps the lights on in a recurring revenue focused business. Monthly new sales is an indication of future billings. However we have not even started to cover a range of other recurring revenue issues such as non-activated customers, churn etc.

This of course has a significant impact on how a sales plan and compensation scheme is constructed for businesses moving to a recurring revenue model from a traditional sales model.

Best practice is to ensure that all key staff, sales, technical and management fully understand the concepts of the Rule of 78 and have a forecasting, sales measurement and compensation model that rewards both new sales and revenue.