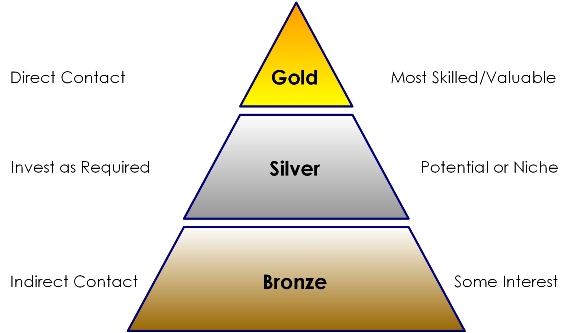

Traditional partner value or vendor engagement strategies have typically been dictated by program requirements. Under this model, partners are assessed according to the level of revenue generated and the level of certification achieved. Based on this assessment, partners are then assigned a rank, within the program hierarchy, of Gold, Silver, or Bronze.

In recent years, however, the advent of new technologies within the channel, such as Cloud and XaaS, has reconfigured the value relationship between the partner and both customer and vendor. The facts emerging clearly indicate that the largest partners are by no means necessarily the most valuable. What is now clear is that the traditional partner value model is not only redundant, but also, more critically, counter-productive.

The Traditional Model

The traditional model has always been that Gold partners, because of the volume of revenue they provide, are entitled to a lion’s share of vendor resources. Our understanding now is that this is, in fact, a flawed assumption and an inefficient deployment of resources.

Gold Partners often have business models deeply aligned with those of the vendor. As such the partnership is, undeniably, one of enduring value. The growth potential of the relationship, however, is questionable, when you consider that Gold partners are often already working at or near their capacity for the specific vendor and its target customers. If growth is to occur at all, it is likely to be at a rate that is incremental.

By nature, Gold partners are, invariably, complex businesses, but largely predictable in their needs and associated revenue. As ‘named accounts’, directly vendor managed, they tend to profile the following descriptors:

- High revenue for the vendor

- Focused into a specific market or customer set – often, but not restricted to, larger or enterprise types of customer, including verticals such as banking, health, and government

- Highly certified or with specialist skills

- Deeply entrenched in the vendor’s technologies, potentially with a “ practice” built around one or more of the vendor’s technologies

- Usually assigned a senior Vendor Partner Manager, who looks after a limited number of like partners

- Provided with a monthly forecast or deal registration pipeline update

- Subject to a quarterly or regular review process

- Provided with MDF assistance for marketing or training offsets

As noted, under a traditional management regime these partners make a significant contribution to the revenue stream, and consume an equally significant portion of vendor resources. And it is precisely here that the anomaly lies. Because, while the ‘Gold’ are undoubtedly important partners, they are unlikely to generate the “over and above” revenues or customers the vendor requires.

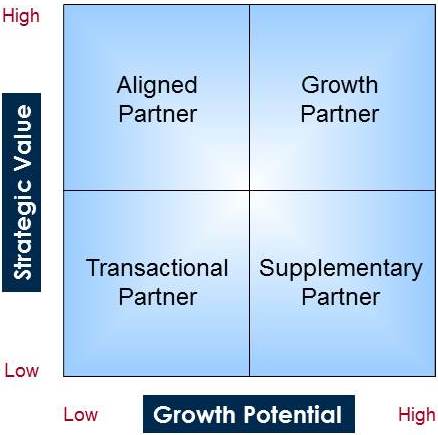

A more strategic way of looking at a portfolio of partners is to assess not what their current revenue or importance is, but what their untapped potential could become. If future prospects signal a significant increase in a partner’s value, then the partnership may well warrant re-classification, and a corresponding shift in the terms of engagement.

Partner Value Model

In our Partner Value Model TM partners are classified based on future value and future potential rather than the traditional current value of traditional programs and tiers.

This approach could be used as an overlay for the existing tiers of the “public program”, thus becoming a vendor resourcing and engagement approach, with powerful implications for individual territory management. The suggestion is not necessarily that this would be an immediate or complete substitute for the existing overarching program, but rather a staged reorientation of program goals, executed at a partner level.

Most vendors already have a global or overarching program, based on tiers. This typically defines and manages partner engagement, requirements and benefits for all partners. In some cases, this may informally focus on partners that have greater potential by providing “over and above” benefits.

The existing program, assuming it is not functionally broken, can and should be left in place in most instances. The Partner Value Model would usually be a temporary internal vendor engagement and resourcing strategy that overlays the formal program tiers, and needs to be funded and supported incrementally and independently of the overarching program. Many of the Growth Partners, after the additional investment has been utilised to effect, could move up a tier, as long as the momentum created by the Growth Partner initiative aligns with the next tier requirements and benefits. Following is a brief summary of the partner classification or Partner Value Model criteria:

Growth Partners

Potential Growth Partners need to be carefully selected to ensure there is a reasonably high probability of sufficient returns, to repay the additional time and investment made in them. This should be assessed using the following schema of requirement:

For a partner to fit into the category of Growth Partner, a management to management business discussion needs to take place, where the partner agrees to buy into the vendor’s vision of the future. This, therefore, assumes that the vendor is already well prepared for a discussion of the ‘what’, ‘where’ and ‘why’ of the vision, and what steps they intend to take to support the partner. Needless to say, there will also be a conversation around costs, and the timeframe projected for the realisation of a return.

While some existing Gold partners may be prepared to make the required investment, and thus place themselves in the Growth Partner quadrant, in all likelihood the majority of Growth Partners will come from the Silver or equivalent tier. With an appropriate level of investment and support, these Silver partners will be able deliver a solution every bit as complex as that of a Gold partner. The critical point here, and the reason for insisting that the traditional Partner model is flawed, is that, given their typically lesser revenue, it would be unrealistic for them ever to hope to achieve Gold status, nor would it necessarily be profitable for them to do so. Yet, in terms of the growth potential these Silver partners represent, it makes perfect business sense for the vendor to invest more in their future than in that of a partner who, even though well-performed in the present, lacks the capacity for anything beyond incremental growth.

Aligned Partners

Aligned Partners are potentially the most difficult to manage under the Partner Value Model approach, as they have traditionally been seen by the vendor as the largest and most important client group. Indeed, it must be said that this is often how Aligned Partners view themselves, a view they feel is justified by the high level of revenue they generate. As a result, there are usually a lot of personal relationships, reputations and egos at stake, which complicates the task of managing this quadrant.

The category name ‘Aligned Partner‘ gives a clue to the engagement strategy required. The momentum of the relationship needs to be kept aligned, in order to avoid losing this partner to a competitive vendor. This requires an appropriate level of investment under the auspices of the overarching channel program and associated tier status of the partner. Diligence must be exercised, however, to ensure that the investment made is not in excess of the value returned – always a danger with Aligned Partners.

As most vendors already do a good job managing their top tier partners, it is not necessary to venture any further comment. It may be worth pointing out, however, that if extra funds need to be found for the Growth Partners, these may usefully be diverted from this quadrant. This should be managed via a gradual process, for the Aligned Partners have become accustomed to a certain level of benefit, which, if removed all at once, could result in a loss of allegiance and, inevitably, of revenue.

Supplementary Partners

Some partners in this group have the possibility of becoming Growth Partners at some point in time, but generally they do not yet meet all the criteria or offer the immediate potential that warrants the level of focus and investment of a Growth Partner. But they still contribute.

These partners may also be smaller in size, revenue and/or resources than the first pass Growth Partners, and, although they contribute to the vendor, it is usually only around a single product, market or technology rather than the broader vendor strategy or offering.

As a result they are more complex to categorise or profile as there are often many factors for and against at play.

Certainly, they are valuable and warrant increased attention beyond their immediate revenue contribution, because they address specific or vertical markets, usually have skills or IP around the vendor’s technology, are certified, and are easy/reliable to engage on leads that match their capabilities or solution.

However, they probably don’t warrant becoming a Growth Partner, since they do not have the financial resources or the capability to invest significantly in the vendor to achieve the required “over and above” growth. They often see their vendor independence as a competitive advantage, and so will not invest further.

In summary, the one-to-one investment required is too great, either in time or dollars, relative to the incremental upside they could provide, compared to that of a Growth Partner. However while there is less potential incremental growth, there is also less incremental work required to at least maintain and still get the best from these partners, as there are already synergies as highlighted above.

The strategy employed to best manage these partners is a scaled back version of that employed for Growth Partners. We recommend a slightly more programmatic approach, as in a one-to-many style of management, rather than the individual and tailored engagement of a Growth Partner.

We would suggest, however, that the same profiling process takes place, so that here is a reasonable knowledge about the partner’s business. Our partner research has consistently highlighted a common theme, namely, that vendors do not spend enough time to understand the partner’s value-add, and therefore partners feel they are squeezed into “one size fits all” program tiers.

In summary, with Supplementary Partners it is wise to invest tactically, but in a less transformational manner.

Transactional Partners

These are the category of partners, regardless of tier or status, who will just transact with the vendor or distributor because the customers they serve want that specific vendor from them.

The bottom line is they are potentially more “fulfillment” oriented or transactional in relation to your products, and, regardless of the volume, providing incremental investment will not significantly alter their behaviour or sales results.

We have seen examples of these partners, where they have been categorised as a Gold tier partner due to volumes, and so qualify for (and expect) all of the volume rebates, MDF and other benefits. But if they go broke, within a couple of months, all of their customers have moved to another partner to fulfill their product requirements with hardly a hiccup on the monthly run rate revenue.

At the other end of the scale there are partners who transact once or twice around a key customer or project with a vendor’s product or technology, giving the illusion of vendor alignment, when they are actually customer aligned and have no intention of expanding their vendor relationship.

While their revenue is still valuable (i.e. you will take their order), “over and above” investing in these types of partners and hoping for incremental growth would not make sense, relative to the other partner choices available.

Standard engagement would be via the overarching program. As to whether this is direct or via distribution, depends on the vendor channel structure.

Conclusion

As stated, this approach of categorising partners into Growth, Aligned, Supplementary and Transactional does not need to be a substitute for the traditional channel program structure. It may, rather, be adopted as an alternative approach for a particular partner profile. In the majority of cases, these would be drawn from the Growth and Supplementary categories, where the additional investment of time, resources and money is warranted.

For vendors with only a few partners to manage and a flat 1 or 2 tier partner program – i.e. certified or uncertified – this approach could be a complete overlay. However, for more established, larger vendors with complex program structures, this approach could be a territory management tool for an individual vendor partner account manager, or a company strategy to assist with channel resourcing and funding decisions.

For more information or assistance with implementing the Partner Value Model TM contact Channel Dynamics at info@channeldynamics.com.au or +61 2 8211 0664