When people refer the “halcyon days” of the IT industry, they are usually thinking of three things – the early 80’s when PCs were $6,000 at 30% margin, the early 90’s when MDF meant “Money for Decadent Functions” or the late 90’s when customers spent more money on technology in 6 months than any other time in history. (I think it might have also been a boom time for bomb shelters and canned foods).

Because if you remember, that was when we learned about the Y2K Bug (a problem resulting from truncating a four-digit year to two digits, which made the year 2000 indistinguishable from 1900). And that spelt doom time for customers and boom time for resellers. But what if the Y2K bug hit today – would partners prosper or perish?

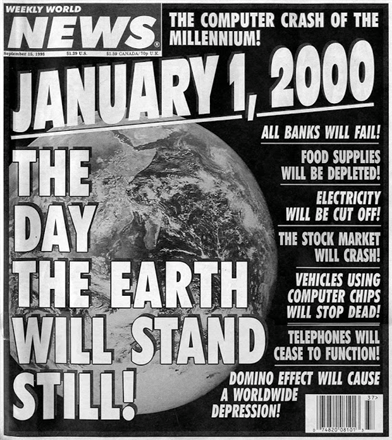

I know it seems crazy when you look back on it now, but these were the types of headlines that appeared in the latter half of 1999.

There was a general feeling of panic. There were queues in front of supermarkets for non-perishable food and supplies. People were withdrawing money from ATMs in case they stopped working (or dispensed cash to random strangers like an electronic Robin Hood). And no-one wanted to be in the air on New Year’s Eve for fear that their plane would fall out of the sky.

For those of us selling IT, it was a bonanza as our customers madly scrambled to get their systems updated. New budgets were approved, new people were hired, and scrutiny on expenditure disappeared if you could somehow blame it on the Y2K bug.

But imagine if that happened today in the era of the Managed Service Provider.

Understanding Risk

As partners move from a traditional Break/Fix model to a Managed Services model, they stand to reap a number of benefits:

• A more regular and more predictable revenue stream

• The opportunity for greater contact with customer

• More opportunity for upselling of additional services

• Increased margin and profitability

But that last one is predicated on managing costs.

When customers sign up to a Managed Services Agreement, they are committing to a certain level of service, at a fixed price, for a fixed term. Once the agreement is signed, the responsibility (and cost) to deliver that service falls entirely on the shoulders of the MSP. If the MSP can reduce their cost of managing that agreement, their profit rises. If the MSP’s costs increase for any reason, their profit decreases, or even turn into a loss.

So if the Y2K bug hit today, it would be the MSP who would wear the cost of updating their systems, not the customer. Even worse, the MSP would not be able to pass on any of the costs to the customer under a fixed price agreement. In effect…

Managing Risk

So what can you do as an MSP to protect yourself?

Understand the Risk – if you don’t have the skills to truly understand the risks in your contracts, seek advice or hire risk assessment professionals to help you understand and price your services correctly.

Offload some of the risk – establish back to back agreements with your suppliers so that you share the risk (a bit like what reinsurance firms do for insurance companies). Yes, you’ll be reducing your profit a little, but it might cost you less in the long run.

Price risk into your contracts – create different pricing levels that increase or decrease the cost to the customer, depending on how much risk they choose to accept. For example, the more scalable or flexible the contract, the higher the price.

Set aside money for a rainy day – create a sinking fund to cope with those unforeseen expenses. If you don’t use it at the end of the year, you can roll it over into the next year, or reverse some of it back into your profit.

Reduce your operating costs – find ways to reduce your costs to service that contract (use remote management software, investigate IoT options, introduce new processes that streamline manual activities, explore options that push tasks out to the customer).

Replace obsolete/inefficient assets – technology continues to become better and cheaper to run, so put in place a process to sell or repurpose older hardware to create efficiencies and/or reduce the running costs.

Factor risk into your contract – Build a clause into your contract that handles unforeseen risk (similar to the “Acts of God” clause in your home insurance contract). Determine what is excluded right at the start so you don’t get caught out.

Have you done anything else in your business to reduce your exposure to risk? Drop me a line and let me know what you think at mmoses@channeldynamics.com.au